Sector Analysis in High-Yield Bond Investing

Sams Corner Bonds.samscorner@gmail.com

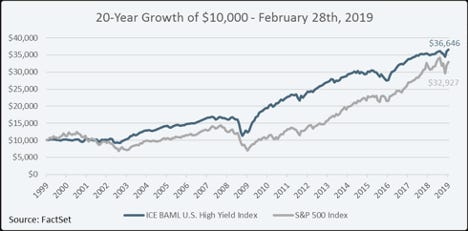

Figure1: Comparison of ICE BAML U.S High Yield vs S&P 500 return

High Level Summary

This report analyzes sector dynamics within the high-yield bond market, focusing on identifying sectors with strong fundamentals and growth potential while highlighting those that may be overexposed or vulnerable. Key findings indicate that the energy, technology, and healthcare sectors currently offer attractive opportunities in the high-yield space due to improving fundamentals and growth prospects. Conversely, the retail and commercial real estate sectors face significant challenges and warrant caution. This report recommends a selective approach to high-yield investing, emphasizing the importance of thorough credit analysis and sector diversification to optimize risk-adjusted returns.

Current Market Environment

The high-yield bond market is currently navigating a complex landscape characterized by persistent inflation, tightening monetary policy, and concerns about economic growth. Interest rates have risen significantly over the past year, with the US 10-year Treasury yield hovering around 4.5%. This has led to a repricing of risk across fixed income markets, including high-yield bonds. Credit spreads have widened moderately, reflecting increased investor caution. However, default rates remain below historical averages, supported by generally healthy corporate balance sheets and proactive refinancing activities in recent years. Geopolitical tensions, particularly the ongoing conflicts in Ukraine and the Middle East, continue to inject uncertainty into global markets, potentially impacting certain sectors more than others.

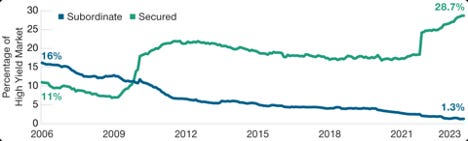

Figure 2: Over the years Comparison of Secured vs Subordinate debt securities

Performance Review

The high-yield bond market, as measured by the ICE BofA US High Yield Index, has delivered a year-to-date total return of 4.2%, outperforming investment-grade corporate bonds. This performance has been driven by the higher income component of high-yield bonds, which has helped offset price declines due to rising interest rates.

Sector performance has been varied:

- Energy: +6.8% YTD, benefiting from higher oil prices and improved balance sheets

- Technology: +5.3% YTD, supported by strong cash flows and growth prospects

- Healthcare: +4.9% YTD, demonstrating resilience amid economic uncertainty

- Retail: -1.2% YTD, facing headwinds from shifting consumer behavior and inflation pressures

- Commercial Real Estate: -2.5% YTD, challenged by work-from-home trends and tighter financing conditions.

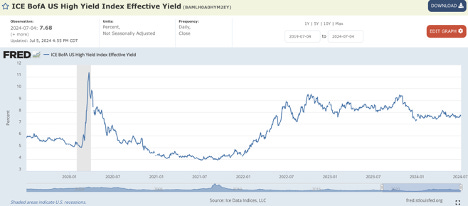

The average yield-to-worst for the high-yield market stands at 8.2%, with an average duration of 4.2 years. This compares favorably to historical averages and offers an attractive risk-reward profile for investors willing to accept higher credit risk.

Risk Analysis

Interest Rate Risk: High-yield bonds generally have lower duration than investment-grade bonds, providing some insulation against rising rates. However, significant rate increases could still negatively impact prices.

Credit Risk: While overall default rates remain low, they are expected to rise modestly as economic growth slows. Sectors such as retail and commercial real estate face elevated credit risk due to structural challenges and changing consumer behaviors.

Liquidity Risk: Market liquidity has decreased in recent years, particularly for lower-rated credits. This could lead to increased price volatility during periods of market stress.

Market Risk: High-yield bonds are sensitive to overall market sentiment and risk appetite. A significant economic downturn or geopolitical event could lead to spread widening and price declines across the sector.

Recommendation and Strategy

· Overweight energy, technology, and healthcare sectors due to strong fundamentals and growth prospects.

· Underweight retail and commercial real estate sectors given structural challenges and elevated risks.

· Focus on BB and select B-rated credits, which offer an attractive balance of yield and credit quality.

· Maintain a diversified portfolio to mitigate sector-specific risks.

· Consider floating-rate high-yield bonds to benefit from rising interest rates while managing duration risk.

· Emphasize thorough credit analysis to identify companies with strong balance sheets and sustainable business models.

Regulatory and Compliance Outlook

Recent regulatory focus has been on improving transparency and reducing systemic risk in the fixed income markets. The SEC has proposed new rules to enhance disclosures for fixed income funds, including more detailed reporting on liquidity risk management. Additionally, there is ongoing discussion about potential changes to the treatment of high-yield bonds in bank capital requirements, which could impact market dynamics. From a tax perspective, the current administration's proposals to increase corporate tax rates could affect the after-tax returns of high-yield bonds, particularly for non-US investors.

Economic Outlook and Forecast

The global economy is expected to experience moderate growth in the coming year, with the IMF projecting global GDP growth of 3.1% for 2024. Inflation is anticipated to gradually moderate but remain above central bank targets in many developed economies. The Federal Reserve is likely to maintain a restrictive monetary policy stance, with the potential for one or two additional rate hikes before pausing. This environment suggests a cautiously optimistic outlook for high-yield bonds, with attractive yields compensating for moderate credit risk.

Appendix and Supporting Data

1. https://www.pimco.com/gbl/en/resources/education/understanding-high-yield-bonds

2. https://www.amazon.com/High-Yield-Bonds-Structure-Strategies/dp/0070067864

5. https://www.cfainstitute.org/-/media/documents/article/rf-brief/rfbr-v4-n5-1.ashx

6. Stable passive income streams with Bonds -A four part Series

7. Stable passive income streams with the High Yield bonds - Medium Investment Grade

8. Stable passive income streams with the High Yield Bonds - Lower Investment Grade

9. Stable passive income streams with the High Yield Bonds - Speculative Grade